travel nurse tax home parents house

Maintaining Personal and Personal Business Ties. When youre working as a travel therapist having a tax home allows you to take housing and per diem stipends provided by travel therapy companies without having to pay taxes on them due to the stipends being a reimbursement for costs incurred at the travel.

What We Spent In A Month The New York Times

Simply put your tax home is the region where you earn most of your nursing income.

. My parents are totally okay with me bouncing back and forth rent free and using their home as my tax-home rent free. I assume that those who believe they dont have a tax-home are harboring this belief because. You have living expenses at your main home that you duplicate because your.

According to Publication 463 the requirements are as follows. Travel nurse using parents home as tax home. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income.

A tax home goes another step further. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage. A tax adviser experienced with these issues can help you work out the details.

First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends. While working as a travel nurse youll receive a compensation package typically called a per diem andor a stipend that reimburses expenses like food and housing expenses. Travel Nursing Tax Home With Parents or Friends If a travel nurse wants to claim a room at their parents house or at a friends the same rule as above applies.

Establishing a Tax Home. So all compensation will be taxed including housing. No you do not have a permanent tax home.

Many travel nurses will scoot around this by keeping an address with a friend or family member. Some travel nurses also choose to rent out their declared tax home while theyre working their travel nursing jobs. This means travel nurses can no longer deduct travel-related expenses such as food.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax. Yes if you are itinerant your home is wherever you are just as with most ordinary employees. For an obscure example.

One of the requirements of maintaining a tax home is that the traveler must have significant expenses in maintaining their principal residence When one rents out their home the. Again this may cause complications that prevent the travel nurse from satisfying factor 2. Obviously this would be nice to be only paying rent in one place.

Or are paid a fully taxable hourly wage taxed on the total rate of pay. Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax-home. Whether the taxpayer performs a portion of the business in the vicinity of the claimed abode and uses.

Apr 18 2014. A bit technical and unlikely that a first line auditor would catch it in my belief anyway. Its where you maintain a livable residence.

You perform part of your business in the area of your main home and use that home for lodging while doing business in the area. This can be a house apartment or a rented room but you need to keep evidence of the regular expenses you incur in maintaining the property or arrangement. There are always technicalities on top of sound bites.

As travel nurses we have to go home sometimes and not abandon our homes. Confusion about the distinction between a tax home and a permanent residence often leads to these common. The IRS requires travel nurses to satisfy three requirements to do this.

You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Make sure you do go back and stay at your house for around 30 days a year.

Thus working four consecutive 3 month assignments is actually greater than a year. The nurse must pay a fair market value for that room and the person that the nurse is paying to live there must claim that rent as income on their taxes. This is a good article that specifically discusses the tax home issue for travel nurses.

You must be able to prove that you contribute a reasonable monetary amount determined by the IRS to a. Why tax homes are so important. However there are HUGE risks with this.

If you do not have a legal tax home everything you are given should be taxed as income including any per diem or housing. There are three objective factors used to determine the bona fide nature of a taxpayers assertion that the claimed abode is the regular place of abode in a real and substantial sense. Having a tax home allows you to save on taxes for certain travel expenses tax deductible expenses when youre away from your tax home.

There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. Travel to and from your tax home counts towards time worked. Basically a tax home is your primary residence where you live andor work.

These reimbursements do not count as taxable income as long as they are provided while youre working outside of your tax home. You will not have duplicated expenses thus you should be taxed on your stipends. Suppose you are audited and cannot PROVE that you have paid market value for a.

Travel nurses may consider renting their home while on travel assignments but this could kill your tax home status. For many travel nurses their tax home is their permanent residence the place where their drivers license is registered. As you know these are the tests for a tax home.

What you are currently making will determine whether a particular assignment pays more or less. Im going to start travel nursing where I take contracts and qualify for stipends. Posted by 1 year ago.

Know the rules and exceptions.

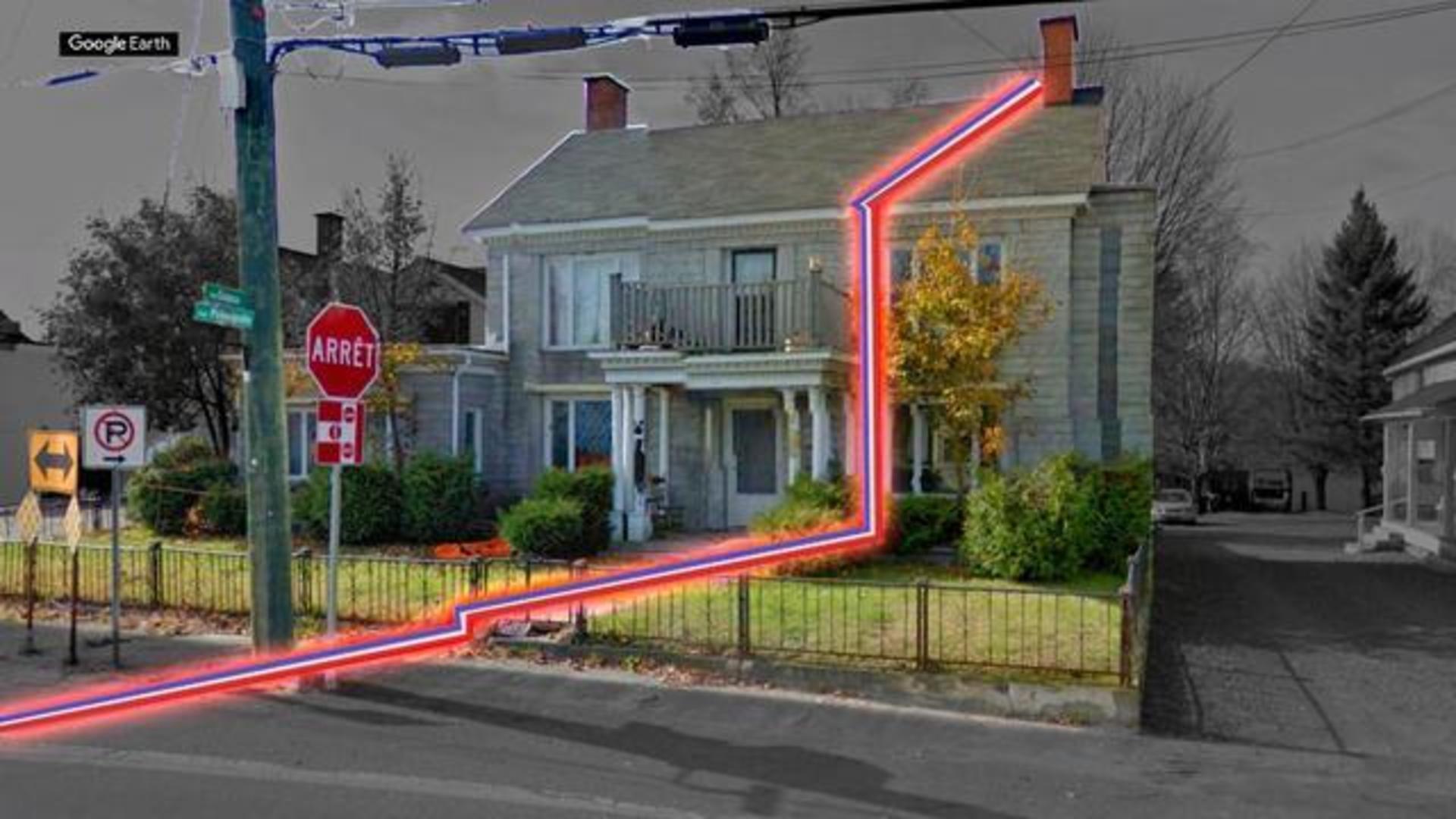

A House Divided Historic Home Spanning Two Countries Up For Sale Cbs News

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Tour Ben And Erin Napier S House Home Town House Tour In Laurel Mississippi Home Town Hgtv Hgtv Master Bedrooms Home

What We Spent In A Month The New York Times

What We Spent In A Month The New York Times

The Addicts Next Door The New Yorker

What We Spent In A Month The New York Times

Home Town Season Six The Hanna House Laurel Mercantile Co

Where Can An Immigrant Afford A House In Canada

365 Printing Inc Best Teacher Ever Ceramic Coffee Mug Mugs Coffee Mugs Best Teacher Ever

America S Mass Migration Intensifies As Leftugees Flee Blue States And Counties For Red

Bc Children S Lottery Bcch Lottery Twitter

What Really Is A Tax Home As A Travel Nurse While On Assignment