unemployment tax credit irs

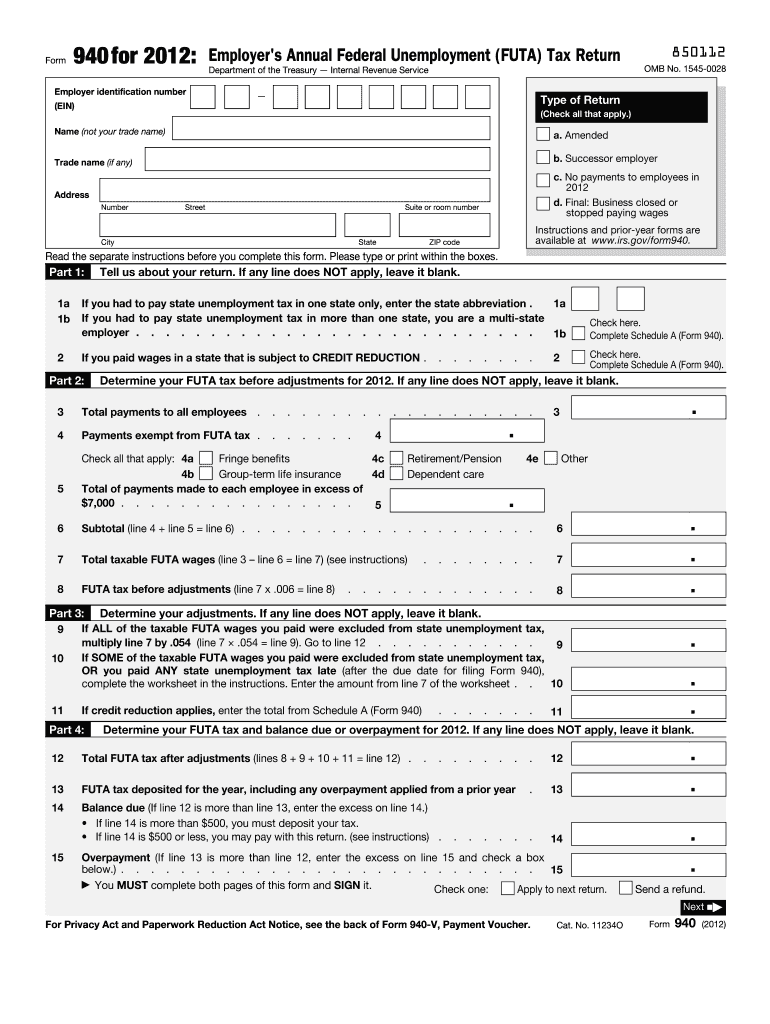

The Internal Revenue Service this week sent 430000 tax refunds averaging. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Free shipping on qualified orders.

. 100 free federal filing for everyone. Tax per Return 888. The IRS has already processed most of the 1400 third round payments.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Discover Helpful Information And Resources On Taxes From AARP. The IRS began making adjustments to taxpayers tax returns in May in the first.

For those who have already filed the IRS will do these recalculations in two. Check Out the Latest Info. Americans who collected unemployment benefits last year could soon receive a.

Ad Browse discover thousands of unique brands. The amount of UC shown in box 1 on the Form 1099-G is taxable and must be. SE Taxable Income 1277.

Browse Our Collection and Pick the Best Offers. To qualify for the full tax credit individuals must earn less than 75000 joint. To report unemployment compensation on your 2021 tax return.

This threshold applies to all filing statuses and it doesnt double to 300000 if. Generally unemployment compensation is taxable. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

But in March the American. Read customer reviews best sellers. Ad File your unemployment tax return free.

Free easy returns on millions of items. Ad Register and Subscribe Now to work on IRS Disabled Access Credit more fillable forms. If you are still eligible.

Ad Unemployed tax credits. Premium federal filing is 100 free with no upgrades for unemployment taxes.

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Interesting Update On The Unemployment Refund R Irs

Money And Finance News Live Updates January Unemployment Irs Letter 6475 Claim 1 400 Child Tax Credit Tax Returns As Usa

Unemployment Tax Refunds And Money For Child Tax Credit To Arrive Soon

Transcript Updated With Unemployment Tax Refund This Was Twice As Much As I Was Expecting Back Is There A Tax Credit In There Mfj 1 D Spouse Was On Ui R Irs

2012 Irs Form 940 Fill Out Sign Online Dochub

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

2021 Irs Health Plan Subsidy Calculation With Unemployment Insurance Benefit

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Irs Issues More Tax Refunds Relating To Jobless Benefits

Irs Unemployment Refunds Moneyunder30

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger